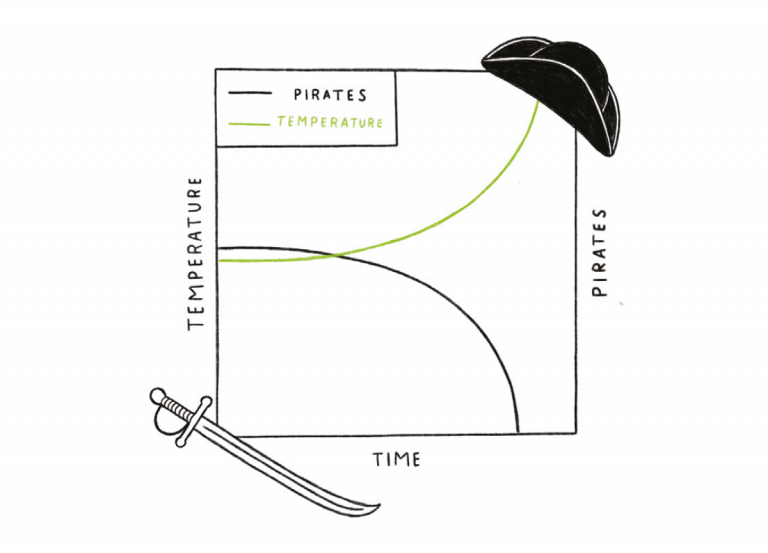

In a business context, whenever possible, avoid jump from correlation to the conclusion.

Instead, use methods designed to infer causality. They are coined “causal analysis” and the latest tech “causal machine learning”.

In such situations not possible to run proper analytics: at least make yourself aware of how fragile your learning is. Try to hypothesize other explanations for the correlation. Evaluate possible A/B testing options.

A warning sign is always when not only the correlation but also a non-correlation, can be wrapped in a nice story.

My advice on “Indirect (Cobra) Effects”: Beware actionism. If you are not sure, doing something can be more harmful than “wait & see”. The latter is an established strategy in medicine and should be in business too.

There are well-established methods in place that can bring light in the darkness. If you educate decision-makers,it needs proper analytics to see root causes of effects, then the causal models will become a standard practice.

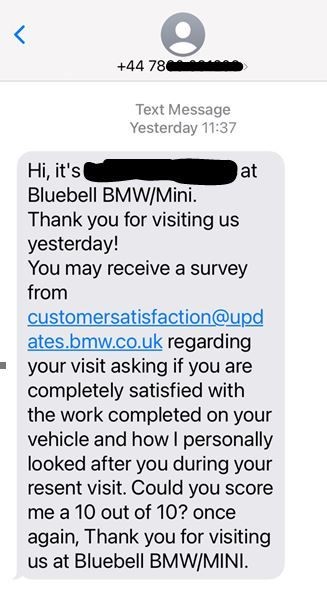

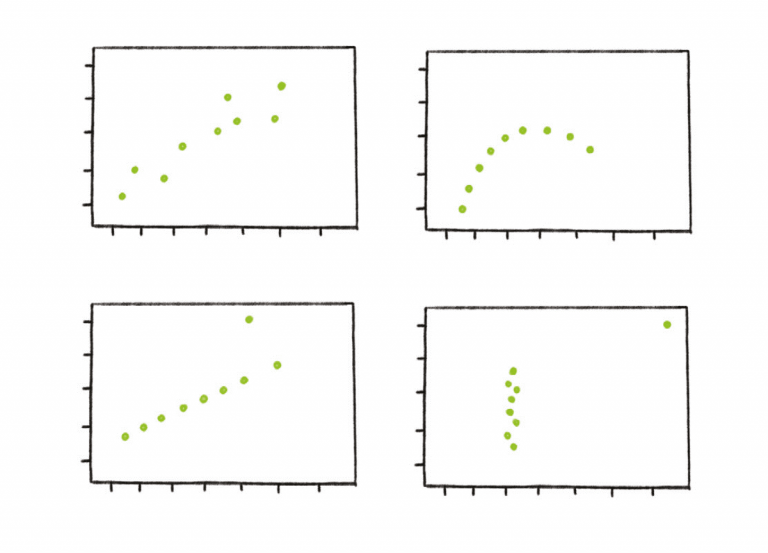

My advice on “Beware Assumptions”: Take a look at raw data first. It will not answer your overall question but can quickly spotlight wrong assumptions you are making.

Practice humbleness. Humans tend to overestimate the validity of what they know – big times. Be aware that most stuff we know about business will turn out to be wrong (or oversimplified) in the future.

Machinelearning is made to model input-output relations with the least amount of assumption. Causal machinelearning has the framework and algorithms to get the insights you are looking for.

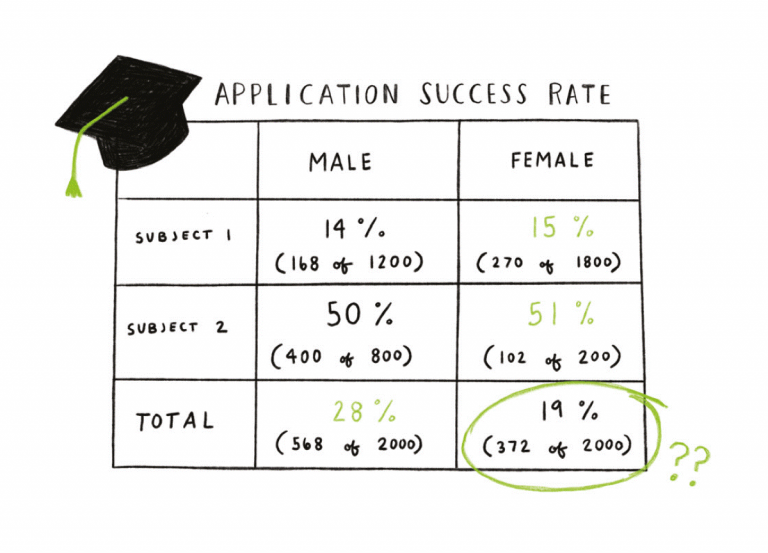

My advice on “Confounder under control”: Berkley University’s example suggests that it is enough to split up the KPI comparison in a two-dimensional table. But this is deceptive.

It needs a good amount of fortune to find the hidden confounder this way. Mostly, you don’t know what you don’t know.

There can be dozens of variables that may turn out to be a confounder. That’s why causal machinelearning is the way to go.

This article further elaborates on how you can spot causation