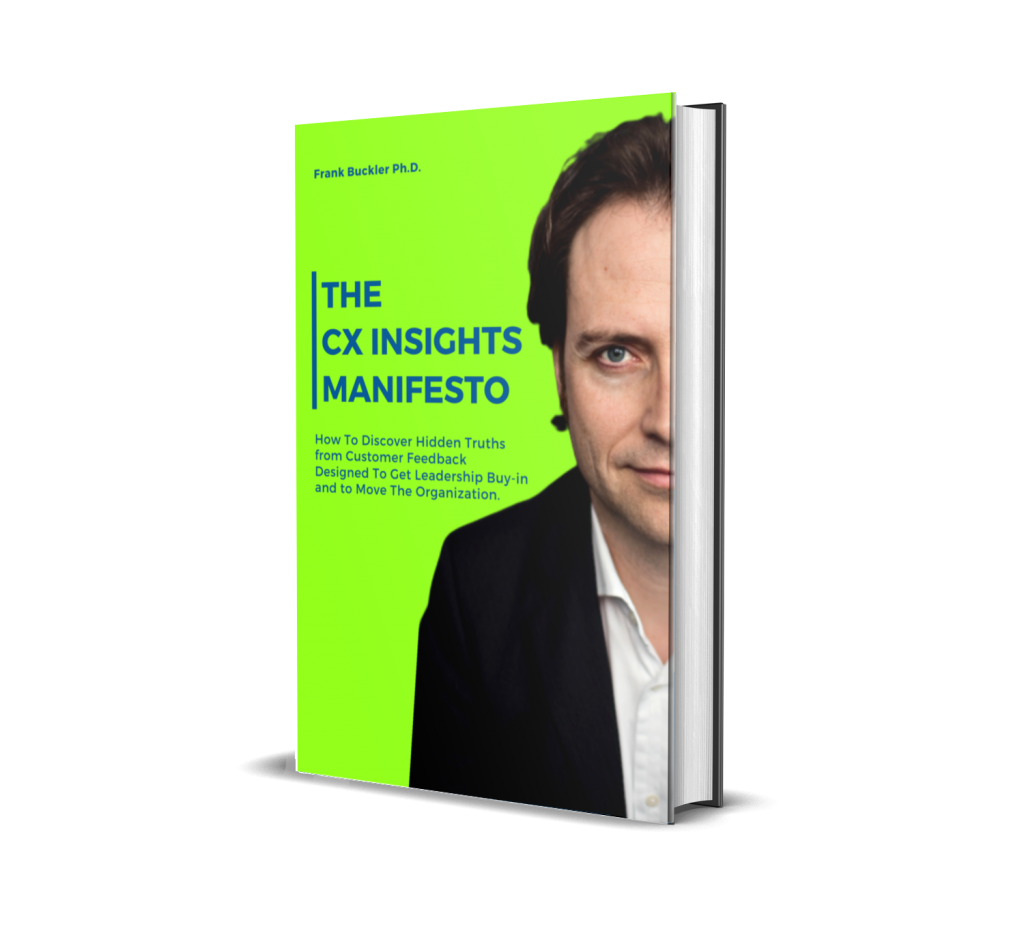

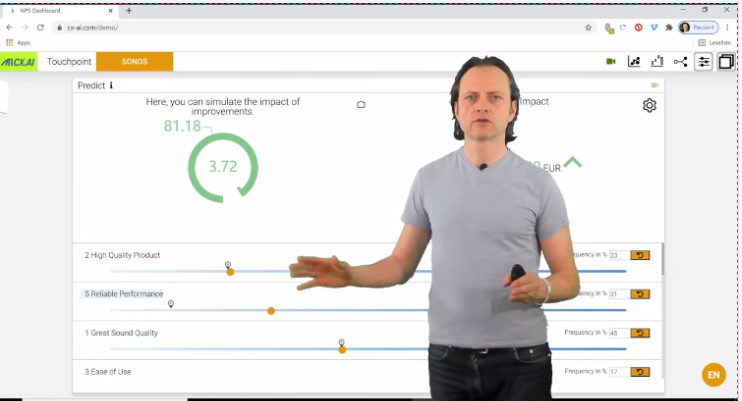

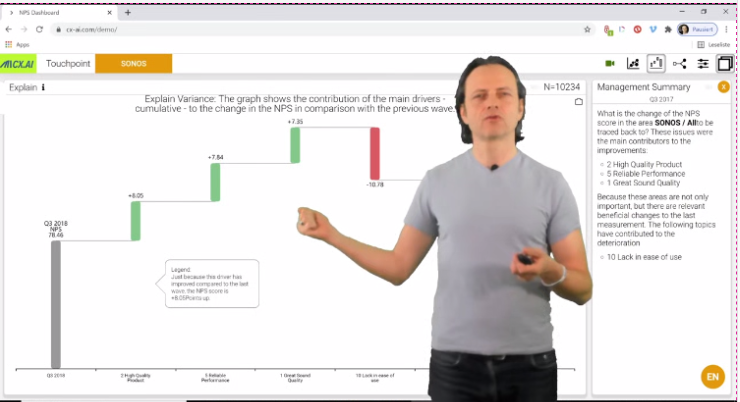

The other step too, in the analytics framework is to identify the impact of the categories. What you see here are these two dimensions. In step one, we categorize everything in categories, which are the bubbles that you can see here.

Frequency – you can if you categorize the verbatims, you can count all Y 20% saying. Great personal service – you can say that. And that’s the outcome of the step one which is counting frequencies and you would expect the discounting gifts. You what topics to work on because I mean, you are asking your customers, Hey, why did you give this rating?

They say… I mean the speakers, they have great sound or the service is good. That’s what they say the first time. And when you ask an insurance customer, for instance, but it turns out that this is you lose me on not correlated with the importance of the category, which is very interesting. That’s why we need step two. There are several reasons for that, which we elaborate in the upcoming blog post. So there is resist impact frequency, illusion. We implicitly assume the most often mentioned topic is the most important one, which is simply not true. And just to give you an example…

Here’s an example from insurance – not so many customers say, you know what I am lacking to recommend because this insurance company is trustworthy, honest, reliable, fair, you know, these kind of sayings. It’s probably a pretty good reason to be satisfied and to recommend your insurance.

And that’s why it’s very likely, or it’s plausible that this has big impact. But not so many people saying it. So why you are not so good at it, you should improve. So this logic tells you that the frequency is not your measurement of what you should do next.

There are these independent things, what they, how often they mentioned things and how impactful they are and this impact needs to be calculated the right way. Typical of the first idea which researchers have is that there’s some you say, oh, that’s right. We need to understand what’s important.

So let’s look what the promoters say, then have a look what detractors say and let’s compare that because when promoters say something different than detractors, that’s probably the reason. And why this may sometimes work. It often doesn’t work. And it is because you would simply look at correlations and correlations, often spirits.

To give you an odd example. When you look at the shoe size of employees in a company the shoe size very much correlates. Was he likely to get to the C-suite? Why? Because men have larger shoes, and for some reasons they are more likely to become a CO or a C-suite. That’s the effect.

And the shoe is some correlation with something else and if you see what you’re measuring now, service, great service, friendliness or staff is knowledgeable. All these things relate somehow together. Thus, building your insights on correlation is dangerous.

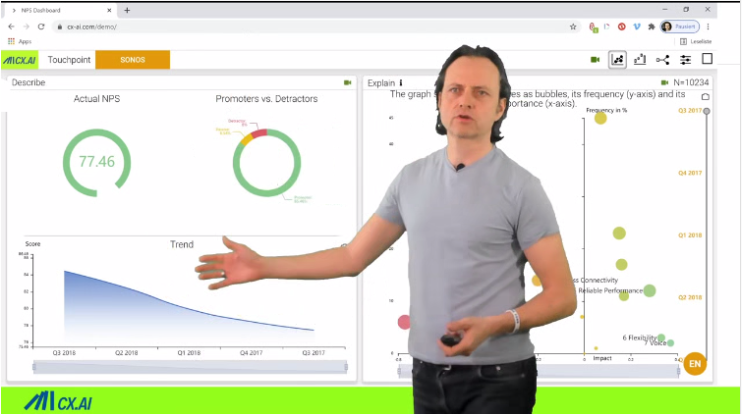

And you don’t want to build on your strategic initiatives to drive on spirits findings. it is easy to do better. And what comes to your mind probably to measure impact is key driver analysis. I mean, key driver analysis, typical methodology. There are of course, many different ways to do it.

To understand the impact of different drivers – that is the method. If you have multiple reasons for success to find out what’s the contribution of each of them. So you need some kind of analytics around key driver analysis. So there are of course elaborations you should consider, and we will go in more details later.

Afterwards, one is a non-linearity, especially when you have a sentiment and you want to understand impact. We see that positive side of the sentiment has lower impact and the negative side. So this is called and non-linearity just an example. So you want that your key driver analysis can model that. I’m just saying that because the convention key driver analysis is basically regression, which assumes the guarantee and independence of drivers and direct impact. So these are the other examples, for instance, interaction, and interactions when you need both, when you need to pray surprise and the product quality only if customers whose praise two things at a time. If this then is impactful, then those two are interacting. They’ve of course interactions as well, you could say only if the quality is great, but there is something else for instance, that the customer is complaining about something.

If this is not there then there are different fields of different ways of interactions, but these interactions, you really don’t know them beforehand. So you want to have a key driver which can spot those interactions. Because the total analysis will make more sense at the end.

It will be more predictive. Another thing you want in a key driver now is to consider mediators. So sounds complicated, but let me give you an example. So for instance, we did this exercise for company who rents out flats and they asking their vendors, what’s your likely to recommend us.

And the most often mentioned topic is and most of mentioned, reason for liking the flat is, a great location. So it turns out it’s also very impactful, but there are other things like the flat has surrounded garden. There’s not a highway next to it.

These kinds of signs are influencing, driving the great location. So there is a mediator effect. That’s a methodology approach that of course the garden and the lack of highway next to your flat is very important, but you cannot see it in a driver analysis because it has an indirect effect through a mediator.

That’s what the key driving should consider. And we will talk about ways to validate all those approaches.